Are you trying to order new checks or checkbooks from Chase?

Well, the process is very simple and it can be done online, over the phone, or even in-branch.

This article will show you exactly how to order new Chase checks step-by-step, and will also show you how to get custom designs and checkbook accessories

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

You can order your checks and checkbooks online by logging into your Chase account or you can order (personal and business checks) on the Deluxe website or by calling 1-888-560-3939.

You can also order both personal and business checks by visiting a Chase branch.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

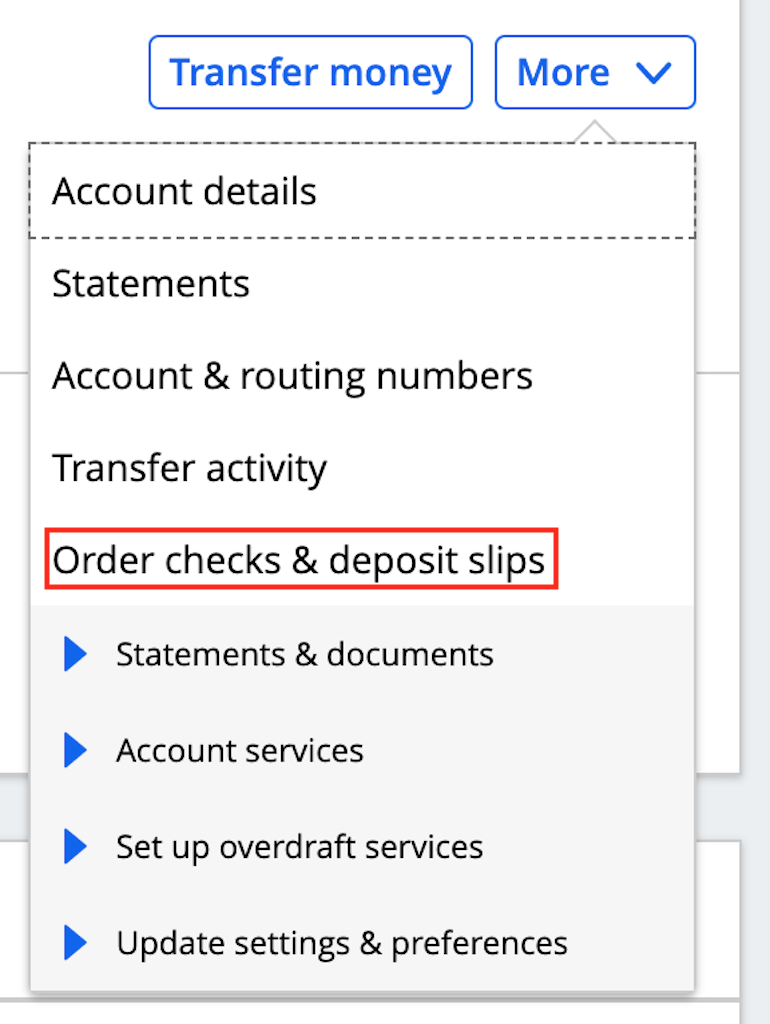

Log-in to your Chase account and then in the Bank accounts section click on “More,” for the account you wish to order the checks.

Then click on “Order checks & deposit slips.”

Make sure that your pop-up blocker or ad-blocker is disabled because a pop-up window needs to come up.

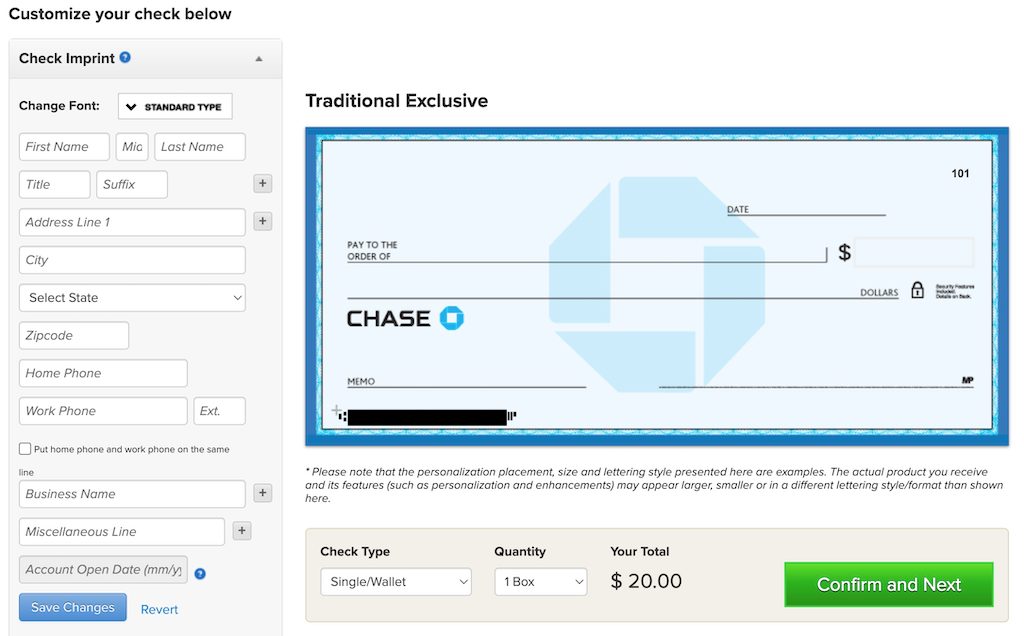

From this window you’ll be able to select the new checks that you’d like to order and personalize those checks if you wish.

Here are examples of check prices as of September 2022. Note that depending on the design that you go with, the prices could fluctuate.

Also, there are some types of Chase accounts that could offer free checks or discounted checks. For example, Chase Private Client offers free personal checks (and no fees for counter checks, money orders or cashier’s checks).

Single/wallet checks are top-bound, single part checks in a standard single/wallet format.

Duplicate checks are top-bound checks with carbonless duplicates for instant copies and fast, easy record keeping.

Most personal check designs have 100 checks per box.

(Mini-Paks have 1 pad of 25 checks per box.)

There are a lot of design options that you can choose from, including:

You can choose the font for your check imprint (where your personal information shows up in the top left corner).

You can choose to put the following info on your checks:

By the way, if you need a detailed breakdown on all of the different parts of a check, click here.

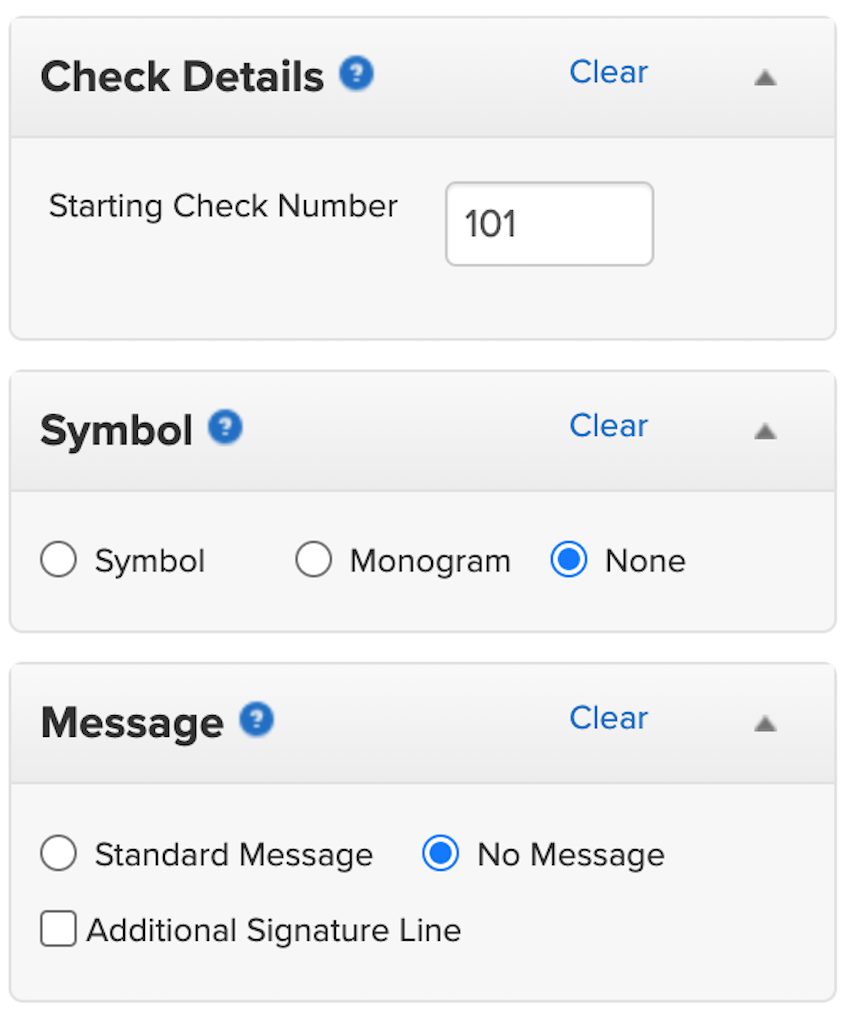

You can also choose which check number you’d like to start from but by default the system calculates the next logical starting number based on your previous order.

A symbol or monogram (also known as a woodcut), may be added to accent the look of your checks. These symbols appear in the upper-left hand corner.

The message (or byline) adds extra character to your checks and is printed above the signature line. You can also choose to add an additional signature line.

A background symbol may be chosen to enhance the look of your checks. These background symbols will appear as a shadow in the background.

You might be wondering what kind of security features your checks comes with.

A line of type normally too small to photocopy clearly.

Cannot be reproduced by copiers or scanners.

The words “Original Document” printed lightly so checks are more difficult to duplicate.

Ink color fades when warmed by touch or breath. If copied, the color will not fade.

This symbol indicates that security features present in the check are described in the Warning Box on the back.

The date line is your name and the check number, in tiny print that appears as a solid line until magnified. Microprint cannot be reproduced by a copier.

Stains or spots may appear if a fraud perpetrator uses chemicals to alter handwritten information on your checks.

Indicates that high security features are present to deter fraudsters.

Chemical alteration attempts result in stains or discoloration in this area.

Deters cut-and-paste alteration attempts.

You’ll also be able to order additional products like leather checkbook covers, labels, debit card covers, debit card registers, name and address stamps, and checkbook registers.

When you place an order for checks, a third-party entity authorized to act as an ACH Originator makes a deduction from your account for the total amount, including any additional fees for expedited delivery, processing, and services.

This will appear on your bank account as an “ACH” fee.

Allow 10-14 days for production and standard delivery.

If you want your checks sooner, there are express delivery options available for most products. Orders with expedited delivery methods placed later in the day may be produced and shipped the next day.

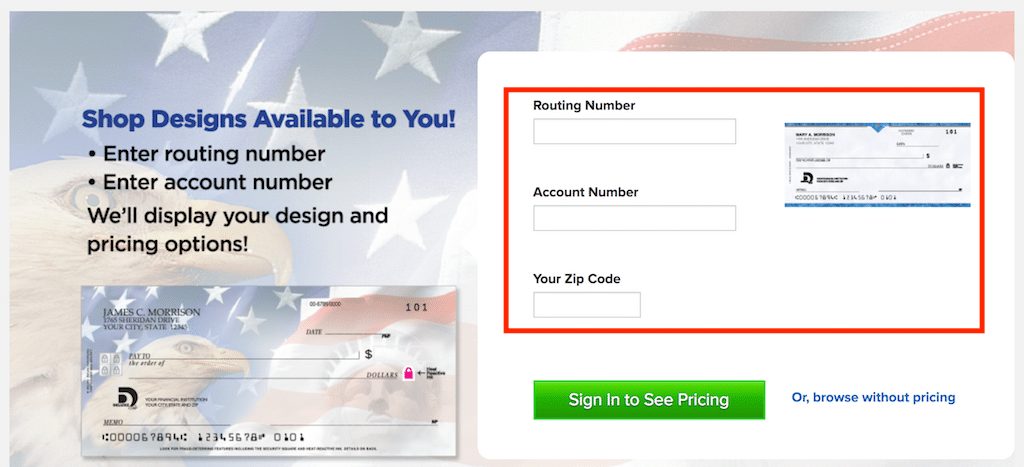

You can order checks on the Deluxe website or by calling 1-888-560-3939.

Make sure you know your routing/transit and account numbers as you’ll need to supply those.

The ordering process on the Deluxe website is very similar to what is above — you can choose the same type of customized options.

You can also order both personal and business checks by visiting a Chase branch.

If you need Chase counter checks (temporary checks) it will only cost you $3 per page if you have a Chase Total Checking Account (or equivalent).

Each blank page consists of three personal checks that Chase prints out on the spot.

Just to be on the safe side, you might want to call up the branch before you to visit them just to make sure that they have counter checks available. If they do, don’t forget to bring your ID and possibly a debit card with you to the branch so they can look up your account easier.

Also remember that some merchants don’t like to accept counter checks due to fraud concerns. You can always inquire with the merchant about that beforehand.

Note: counter checks are different from Cashier’s Checks which are $10.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

You can change the address on your checks as part of the ordering process, but this doesn’t change your address in the Chase system.

So you’ll need to make sure to change your address directly with Chase which you can do at 1-800-935-9935 or by visiting a Chase branch so they can update your address.

If you’re interested in pursuing Chase credit cards you should read my guide here.

The price of your checks can change based on the type of designs you choose but you can expect pay around $20 to $25 per box.

How many checks come in one box?Most personal check boxes come with 100 checks.

Do Chase checks come with security features?Chase checks can come with lots of security features which include things like micro printing, heat reactive ink, chemically sensitive paper, fraud warnings, and other features.

How can I pay for my checks?You can pay for your checks by authorizing an ACH transfer directly from your bank account.

How long does it take to receive your checks?You should allow about 10 to 14 days for your checks to be delivered with a standard delivery.

If you need checks sooner than that you can order express delivery which may be produced and shipped the next day.

Can I get counter checks?Yes, you can get counter checks from Chase. These are issued three checks per page which will cost you $3.

Ordering Chase checks and check books isn’t difficult at all and it can be done online, over the phone, or in-branch. If you’re not ordering directly through Chase, be sure to take down your routing number and account number so that you can fill out the forms properly.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.